When it pertains to online purchases, utilizing a card is the most practical method to make our purchases. Despite the benefit, keying our card number on the internet brings some threats, and we need to take care. In this guide, we will certainly see carefully what is a bank card, a debit card, and prepaid card, the pros and cons of each technique, and what to keep an eye out for in online transactions.

Unclog any type of worldwide website, surf anonymously, and download and install flicks and Mp 3 with complete security with CyberGhost, simply for $ 2 75 monthly:

Pre paid cards

It is an offered reality that many individuals are worried regarding the threats of online purchases. They choose cash money on shipment or financial institution transfer and stay clear of companies that do not use any of these alternatives.

Pre paid cards are the remedy to these issues considering that we can use them similarly we would certainly perform with cash money.

The pre paid card is a reasonably new development in the area of bank cards. It has actually been around for numerous years, yet it was created much behind credit report and debit cards.

Basically, our bank problems a card, and we can top it up with any kind of quantity we desire. Then, we can use this card anywhere we want till it runs out of cash.

Pros

Prepaid cards are thought about to be the best technique for on-line shopping. If we cover it up with a tiny amount of money – let’s state $ 10 – this is the optimum danger we take, in situation something goes wrong.

As a matter of fact, some services, such as paysafecard, do not even need a checking account or accessibility to a credit history or debit card. We can do everything with just a few clicks on our computer or smart device.

These cards generally do not have our on them, which may be requested when paying by card. However, they are gotten in touch with our name and address in our bank’s data source.

Cons

The major negative aspect of prepaid cards issued by banks is that they generally bill a tiny fee each time we cover up our card.

If we have not utilized the card for a long period of time, we might face even more fees. Generally, the duration that establishes whether an account is taken into consideration non-active is 12 months.

Pre paid paysafecard

paysafecard also belongs to the group of pre paid cards. It may not have the conventional card format, however it has the very same advantages in reducing the threat of on the internet repayments.

It is approved in hundreds of online stores, such as Heavy Steam, PlayStation Shop, Trouble Games, Epic Games Shop, Wargaming, and even Jerk.

It is worth noting that the paysafecard transcends to the matching pre-paid bank cards due to the fact that it does not charge a payment.

As an example, if we purchase a prepaid card of $ 10, we will certainly have the full amount at our disposal, which we can utilize in all businesses that approve a paysafecard.

Also, unlike other gift cards, we can use the very same paysafecard for numerous acquisitions in different organizations.

There are greater than 650, 000 sales electrical outlets throughout the world, where we can buy a paysafecard. These include many grocery store chains, blog post offices, kiosks, and so on.

We can also acquire a paysafecard online 24/ 7 To use a paysafecard, all we need to do is to produce a complimentary account.

As soon as we prepare, we can also add pre paid codes that we might have bought from physical stores.

As a result, we can use our paysafecard account to check out when we intend to purchase anything on the internet.

Additionally, we can cover up our account with more cash. If the amount goes out, our account will not be charged anymore. It just won’t help purchases till we top it up.

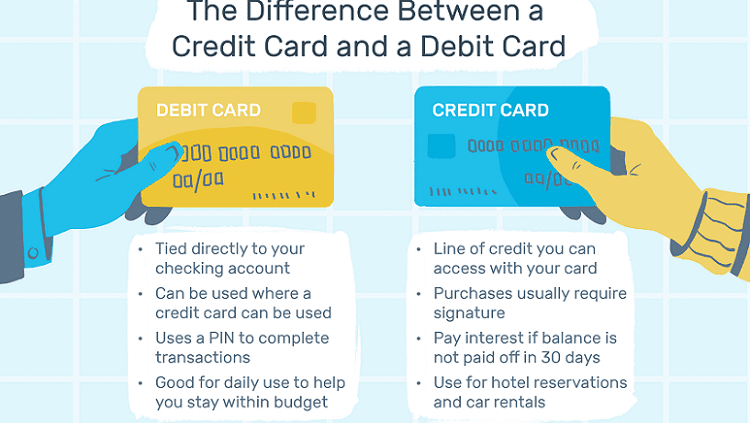

Credit cards

Charge card can be a double-edged sword.

If we use them correctly, they are handy and offer substantial benefits compared to various other payment methods. If we misuse them, they can destroy our lives.

As we all know, a bank card is basically “borrowed” money. If we have a month-to-month limitation of say $ 1000, the bank lends us money for every single payment by card, up to that restriction.

Naturally, every month we have to settle the credit history. If we pay the sum total, we will certainly not be billed any type of rates of interest for all the acquisitions we made throughout the month.

Yet if we pay only component of the quantity, or we can not pay, we will certainly be billed a much higher rates of interest than other forms of financing.

Pros

The wonderful advantage of bank card is the motivations they give us to use them.

Some cards give us a cashback on every purchase, for example, 10 % of the acquisition. And in specific companion firms, the price of return may be higher.

Various other bank card might offer points for each acquisition made. We can redeem these factors for various products or services from a provided checklist. For instance, some credit cards give airline company miles.

These sorts of advantages are hardly ever located on other sorts of cards. Some individuals have several kinds of debt, which they utilize in turn to accumulate various rewards.

Also, a lot of business allow shopping in installations only with a bank card.

Ultimately, any kind of uneven charges on a bank card are typically less complicated to reverse if we spot them promptly than other types of cards.

Cons

The disadvantage of credit rating is that if we have several cards and use them carelessly, a lot more than our revenue warrants, we will certainly soon be stuck in debt at a very high-interest price.

The majority of us recognize people who remain in this circumstance. They have multiple cards in the red each month and issue new cards to debit old ones. The outcome is that it is testing for them to get out of the debt cycle.

Lastly, whether we will certainly obtain a credit card and just how huge our credit limit will be, depends upon the income we state in our income tax return.

The standards are much more stringent today than they were decades ago. Low-income individuals may not be able to get a charge card whatsoever.

Debit cards

For numerous years now, if we have a bank account, we likewise get a card that allows us to withdraw cash from an ATM or be utilized in any acquisitions. This is called a debit card.

Pros

Basically any person can have a debit card, even if they have only one bank account. The problem of a debit card doesn’t rely on our revenue.

Instead of carrying cash money, we can use this card, and the quantity is immediately debited to our savings account.

Likewise, there is no monthly cost that we pay for the card neither any type of interest rate.

Cons

However, as we pointed out, the debit card is directly linked to our bank account. In situation of loss or theft, or if we fall victim to online scams, the burglars will have straight access to our cash.

Many debit cards have a limit, daily and even regular monthly, to not empty our account before we terminate the card. Yet this restriction is most likely greater than the limit of a bank card.

We should also ask our financial institution regarding their debit card policy. What if we discover uneven charges? Under what problems can we get our cash back?

Lastly, note that some payments might need a bank card, not a debit card.

As an example, renting out an automobile usually requires a credit card, not a debit card. The exact same goes with different other kinds of deals.

What to watch out for in each kind of card

Here are five key tips we should all be aware, before using any type of card online.

Where do I enter the card’s number, and why

The first is that we need to understand specifically what will take place if we enter our card number into any site.

If it is a buy from an e-shop, generally just before the payment, we will certainly see an introduction of the items we have selected, together with shipping and perhaps other charges.

In online solutions, nonetheless, things are not always so clear. For instance, several services request a card if we want to do a complimentary trial.

Our card is not charged during that time. Nonetheless, if we do not terminate the service in time, it will certainly begin charging automatically as soon as the totally free test runs out.

We have actually seen something similar happening in software products. For example, we could buy an application today at a significant discount rate. We are immediately billed the complete cost for the most recent version of the same application one year later on.

The very same goes with regular monthly or annual memberships. They promise a reduced rate only for a while, and then the expense rises dramatically.

Finally, some pages request for a card to accredit that we are grownups. Often this will register us for so-called “benefit” subscriptions to sites of this kind.

Hence, we should constantly check out all the terms before entering our card’s number. Especially in free tests or for age verification, we need to be extremely cautious.

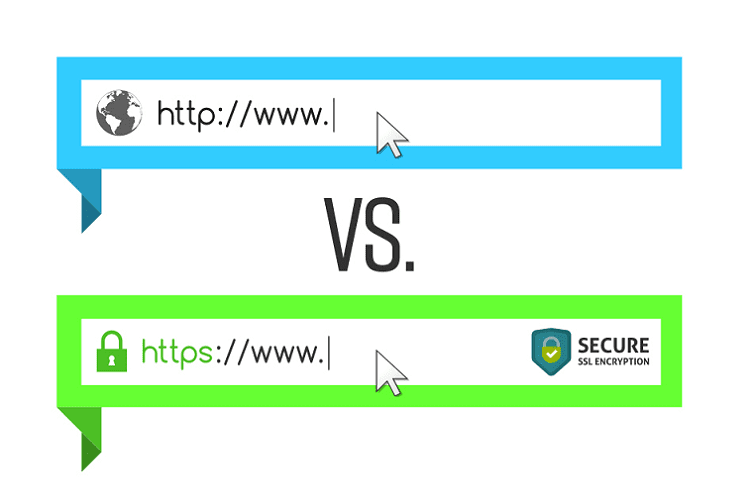

Inspect what the web browsers reveal

The 2nd point to keep an eye out for before using a card online is specifically what the internet browser displays in the address bar.

At first, the address has to start with HTTPS, which suggests that our communication with the web page is secured. We need to NEVER utilize a card or any one of our individual details on a web page with simply HTTP.

Chrome has actually been immediately concealing both HTTPS and “www” in the address bar for several variations. Nonetheless, if a web page does have HTTPS, Chrome shows a secured padlock just before the address. You will certainly locate a similar lock in Firefox and most other web browsers.

To highlight how essential this is, Chrome marks web pages as hazardous if they have simply “HTTP.”

This does not suggest they threaten. Nonetheless, it is certainly not safe to enter our individual information or our card number.

Be careful of Phishing

We need to most definitely take notice of the internet site address itself prior to entering our card number.

We need to see to it that we are going into the number on the website we desire and not to a 3rd website that copied a recognized web site’s design.

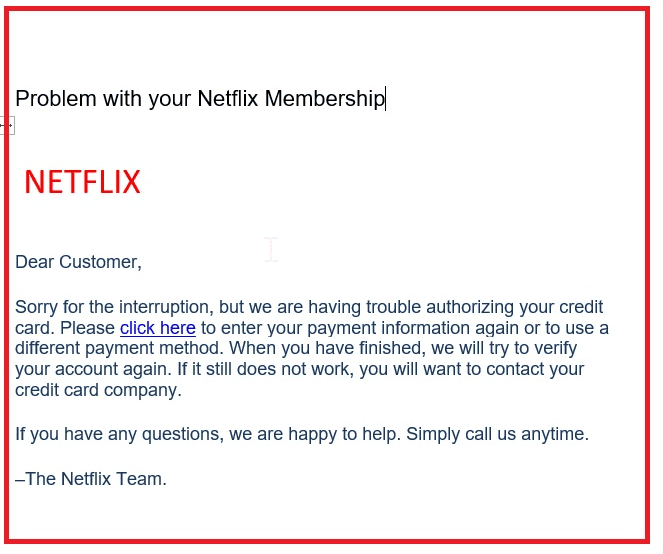

For example, a viral scam pertains to Netflix. We might receive an email that there’s an issue with our Netflix subscription, and we have to re-enter our payment information.

If we adhere to the mail’s web link, it will take us to an internet site that resembles Netflix. Nevertheless, this website is organized on a various server and has a various domain name.

Nothing goodwill take place if we enter our card information on such a site.

This kind of scam is called “Phishing.” Besides Netflix, these sorts of emails could pretend to come from our financial institutions.

In instance we obtain such an email, we should not comply with any kind of link. The best we can do is open up a brand-new tab and visit manually to the website’s user panel, whether it’s Netflix.com or our financial institution’s web site.

If there’s any kind of problem with our account, we will certainly see it in our customer panel. If we can’t see any type of problems, we need to note the email as spam and erase it.

In any case, if we still really feel there could be a problem with our account, we can call our financial institution and ask for details.

Updated devices

We need to always maintain our gadgets clean from malware and up-to-date. Additionally, we need to upgrade our antivirus software program daily. Furthermore, we need to take note of the websites we see and the data we download.

There specify classifications of malware devoted to taping what we type, what we see on our display, what we copy/paste, or a combination of these.

Such applications look especially for credit card numbers or credentials for our e-banking.

Individuals who download broken software program and video games are at a higher risk of running into such malware. The exact same chooses individuals who open up attachments from emails without being sure of their beginning.

In general, an upgraded anti-virus suffices for security. There are also advanced approaches, such as:

- An unique sandboxed browser for on-line settlements

- A live linux circulation on a USB stick that we utilize exclusively for repayments

Did we observe any strange charges?

Last but not least, we should constantly monitor our card’s fees. It is necessary to acknowledge every acquisition that we made.

We need to make it a habit to consider the charges on our card routinely, ideally once a day. We can do this either through e-banking or via a card-specific application, if available.

If there’s any cost that we do not recognize, we should call our financial institution, also if it’s a percentage.

The earlier we spot such settlement and notify the bank, the more probable we will certainly reverse it.

Do you go shopping online with a card?

If you wish to share your opinion regarding on the internet shopping or your personal experience with a credit history, debit, or pre-paid card, you can write us in the comments.

Assistance PCsteps

Do you want to support PCsteps, so we can upload premium quality posts throughout the week?

You can like our Facebook web page, share this article with your good friends, and pick our associate web links for your acquisitions on Amazon.com or Newegg.

If you favor your purchases from China, we are affiliated with the biggest global e-shops: